Ram Dodge Truck Financing Options

Introduction

Buying a new truck can be a significant investment, and Ram Dodge trucks are some of the best on the market. But what if you don’t have the cash upfront? Financing options can make your dream truck more accessible. This guide breaks down all you need to know about financing a Ram Dodge truck.

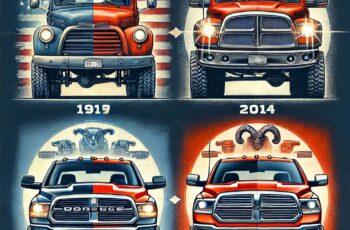

Understanding Ram Dodge Trucks

Ram Dodge trucks are known for their robust performance, spacious interiors, and cutting-edge technology. Whether you need a truck for work or adventure, these vehicles deliver reliability and power, making them a top choice for many.

Why Financing Matters

Purchasing a vehicle outright isn’t feasible for most people, and financing offers an affordable alternative. With financing, you can spread the cost of your truck over several months or years, making it easier to manage your budget.

Available Financing Options

Dealer Financing

Ram dealerships often provide in-house financing options. These can include special offers like low-interest rates, cashback incentives, or deferred payment plans. Dealer financing is convenient since everything is handled in one place.

Bank Loans

Banks offer traditional auto loans, which often come with competitive interest rates. However, you’ll need a good credit score to qualify for the best terms. The approval process may take longer compared to dealer financing.

Credit Union Loans

Credit unions are known for offering lower interest rates than banks. If you’re a member, this can be a great way to finance your Ram Dodge truck at a lower overall cost.

Special Offers from Ram Dodge

Ram frequently provides limited-time deals, such as 0% APR financing for qualified buyers or cashback offers. These promotions can save you thousands of pounds, so it’s worth checking for any ongoing deals.

Lease vs Loan: Which Is Better?

Leasing a Ram Dodge truck allows you to drive a new vehicle for a lower monthly payment, but you won’t own it at the end of the lease term. A loan, on the other hand, gives you full ownership but usually comes with higher monthly payments. Choose based on your long-term goals.

Understanding Loan Terms and Rates

APR and Interest Rates

The Annual Percentage Rate (APR) reflects the total cost of borrowing. Comparing APRs from different lenders helps you identify the most affordable option.

Loan Duration

Shorter loans mean higher monthly payments but lower total interest. Longer loans are easier on your monthly budget but cost more in the long run.

Requirements for Financing

Credit Score Requirements

Your credit score plays a crucial role in financing approval and the interest rate you’ll receive. A score above 650 generally qualifies for better rates.

Required Documents

Lenders typically ask for proof of income, identification, and details about the vehicle you intend to purchase.

Tips for Securing the Best Financing Deal

Shop around for offers, compare rates, and don’t be afraid to negotiate. Pre-approval from multiple lenders can give you an edge when discussing terms.

Steps to Apply for Financing

Start with pre-approval to determine how much you can afford. Once approved, review the terms carefully before signing the agreement.

Financing for Buyers with Bad Credit

If your credit isn’t great, don’t worry. Some lenders specialise in bad credit loans, though these usually come with higher interest rates. Improving your credit score can increase your chances of approval.

Advantages of Choosing Ram Dodge Financing

Ram’s financing options are designed with buyers in mind. Flexible terms, competitive rates, and additional perks like maintenance packages make them a strong choice.

Conclusion

Financing a Ram Dodge truck doesn’t have to be complicated. With various options like dealer financing, bank loans, and credit unions, you’re sure to find a solution that fits your budget. Take the time to explore offers, compare rates, and make an informed decision to get the truck you’ve been dreaming of.